Earlier this month, the Indian arm of the $52.5-billion Walt Disney Company announced it was giving up on the Indian film business.

“Given the challenges with the current economic model for investing in the local film industry, we intend to shift the focus of our film strategy to driving our Hollywood movie slate in India,” a Disney India spokesperson said.

Soon, the rumour mills went into overdrive. Balaji Telefilms was exiting films. And, Eros was certainly in trouble with a class action lawsuit by a bunch of American shareholders; Viacom18 Motion Pictures had already scaled back and so on it went.

Are Indian studios shutting down en masse? “There is no question of stopping or shutting down. There is too much hullabaloo and gloom. Sometimes movies and studios do well, sometimes they don’t,” says Sameer Nair, group CEO, Balaji Telefilms.

The Rs 293-crore Balaji which gets a bulk of its revenue from television is having a bad year at the movies. The massive leak of Great Grand Masti 17 days before its release and the insipid Flying Jatt have piled on losses upwards of Rs 40 crore.

Viacom18 Motion Pictures has not had a release for two months. But COO Ajit Andhare says: “We are under no pressure.” He points out that the studio has always had a smaller slate because it believes that economies of scale work, only when there is backward integration into production.

In an earnings call last week, Jyoti Deshpande, group CEO of the Rs 1,603-crore Eros International said, “Others are just going through that learning curve (that we went through) now.”

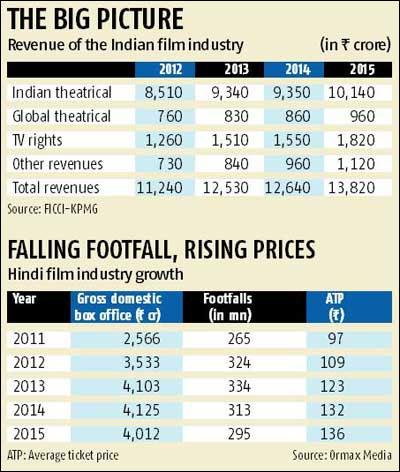

So what prompted Disney’s decision? The flopping of the Rs 100-crore Mohenjo Daro or the success of The Jungle Book. Analysts reckon it is neither. The last three years have seen the Rs 13,800-crore Indian film industry battling falling margins, rising costs and a stagnant box-office.

While the overall (revenue) numbers for the Hindi film industry show a rise, footfalls have actually fallen, says Shailesh Kapoor, CEO, Ormax Media, a consulting firm. (See chart)

While the overall (revenue) numbers for the Hindi film industry show a rise, footfalls have actually fallen, says Shailesh Kapoor, CEO, Ormax Media, a consulting firm. (See chart)

The rise came because of increase in average ticket prices. Disney’s decision is simply a reaction to poor profits. The company declined to comment beyond the official statement.

“It (Disney’s decision) is a bit of a shock. They spent half a billion dollars in buying a majority in UTV and part of that was buying the leading studio and that has come undone. It tells you that something else is going on in Indian filmmaking,” says Patrick Frater, Asia Editor, Variety.

Is this just a rough patch or is the Indian film industry an unviable mess?

The agony of transformation

To get an answer travel to Ormax Media’s offices in North Mumbai. From about one a month, it is now testing 7-8 scripts. Script testing works by using an audio narration to gauge the word-of-mouth a film is likely to get. This is then used with analytics to predict the box office collections.

For example, if Neerja (a hit) opens at Rs 4.5 crore and so does Bombay Velvet (a flop), the difference in the word-of-mouth between the two is a fairly accurate indicator of their potential success or failure.

The script test is used to tweak, junk or greenlight a film. “Earlier, most people were testing films (after they are made), now they prefer to test the script,” says Kapoor. Needless to say, it is cheaper to junk a script than do that to a ready film.

The huge rise in script-testing is the single biggest indicator of the correction that the business is going through. It shows an industry that is fighting its battles, cleaning up processes at the production end. It is not the glamour part of the business, but a critical step in the journey that began in 2000.

Back then, the world’s largest film producing country was a financial and creative mess funded in parts by the underworld. Then it got industry status and was allowed to raise money like other businesses.

Multiplexes and digital single screens took off, and average ticket prices rose. Soon, global majors such as Disney, Paramount, Fox – all with profitable TV businesses in India – decided to come in.

From 2007 to about 2012, there was a lot of money chasing scale pushing up the prices for actors, directors, technicians et al.

The film business in India transformed creatively and commercially. The money is clean; distribution and screening are no longer messy. The films are an interesting mix of the well-made popular (Piku, Sultan) and critically-acclaimed films (Gangs of Wasseypur, Masaan) that do India proud at major film festivals.

Indian film talents – Irrfan Khan, Priyanka Chopra and A R Rahman among others – are picked on pure merit for global projects. But profitability remains patchy.

There are several reasons for it, but it all boils down to two things – “screens and piracy,” says Nair. These eat into footfalls and that affects what the business finally makes.

“Today Salman draws roughly half the footfalls with Sultan than he did more than 20 years ago in Hum Aapke Hain Kaun. That is a real issue,” says Andhare.

For an industry that gets more than three-fourths of its revenue from the box office, India has been losing screens at an alarming rate. There are barely 10,000 left from about 12,000, five years back.

Rising ticket prices have made multiplexes, “the preserve of the rich,” says Andhare. Their average occupancy remains 30 per cent even while single screens continue to down shutters.

For more than five years now, the number of Indians watching films has fallen consistently – from 82 million in 2010 to just about 78 million in 2014. That is when box office revenues screeched to a halt. And that is when the griping on talent costs and margins began.

“We need to step back and review. Sure talent costs are high, but that holds true for many industries. The fundamentals of the film business remain intact. South India continues to take bolder steps and they are finding success… it is time perhaps to rethink the business,” points out Rakesh Jariwala, film segment leader, media and entertainment industry, EY.

“The model will further evolve with digital as Netflix, Amazon Prime, Eros Now, Jio and others look for content and offer more windows to monetise better, by making more money from the same copyright,” he adds.

Kapoor agrees: “Suddenly a lot of people are saying that studios are not working. That is an oversimplification. The problem is one of business model.” Disney’s decision to quit will “put a very nice downward pressure on talent costs and content costs,” as Deshpande puts it.

The fact is more Indians are watching films across screens, TV, online and other platforms than ever before. Whether it is by tackling costs, processes or revenues, the trick is to find a way of making money from all of them.

[source;rediff.com]