A government housing society with a single occupant. Photo: Pradeep Gaur/Mint

Time has stood still for the ghost housing societies of Greater Noida. Three years ago when this correspondent walked the broad roads of Sector MU-I in Greater Noida, with their lovely service road trees leading to gated communities, he had found few people actually living in the fully finished housing societies. Now in June 2018, nothing much has changed. What looks like an ideal picture perfect housing dream—villas, trees, roads, parking, community centre, parks—has one thing missing: human beings. If at dusk, the sight of the empty lightless windows gives the ghost town its name, even in the bright June day there were hardly any people in the area to point out directions.

In sector MU-I, that was built by the Uttar Pradesh government more than a decade ago, four out of five houses are vacant and many of the empties are badly dilapidated. Despite the existing empties, a little ahead of the existing residential block, another block of low-rise government housing with about 1,000 apartments is under construction. Several private developers are also building high-rise residential apartments in the area. The multi-crore question to this correspondent came from the befuddled cab driver—if already people are reluctant to live, who will buy the new flats?

Also see: In Photos: The ghost societies of Greater Noida

The answer to this question is the answer to why there are ghost societies in Greater Noida and elsewhere in the Delhi suburbs. Sector MU-I is not an isolated case; there are other sectors with residential complexes, both government and private, in Greater Noida sharing the fate of this sector. The ghost complexes exist in other areas of NCR like Greater Noida West (earlier known as Noida Extension), Raj Nagar Extension, Nahar-par areas of Faridabad, Kundli, Dwarka-Expressway and so on. Most of these locations have occupancy levels of 10-40%.

The ghost complexes of suburban Delhi are part of a larger pan-India story. According to the 2011 Census of India, out of 331 million houses in the country, 25 million were vacant. The highest number of vacancies were seen in Maharashtra with about 3.7 million vacant houses, followed by UP with 2.4 million vacancy. Above 95% of the houses surveyed were in a good and livable state, still there are so many vacant houses.

What’s going on? The demand for housing is very high,but the price point needs to be right. Why are there fully loaded homes in which nobody is living, why don’t prices come down?

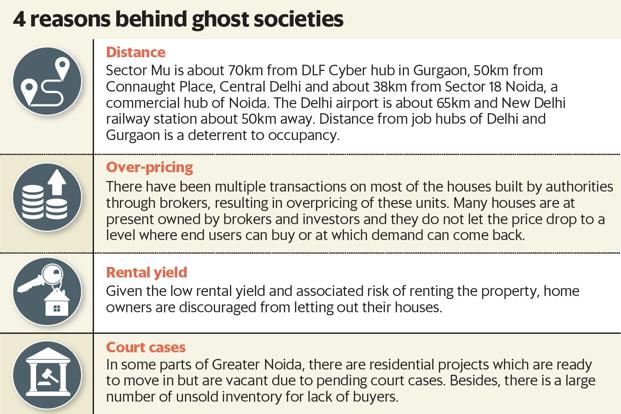

THE PROBLEMS

Distance: Sector Mu-I is about 38km from Sector 18 Noida, a commercial hub of Noida, 50km from Connaught Place, central Delhi, and about 70km from DLF Cyber Hub in Gurgaon. Distance from the job hubs of Delhi and Gurgaon is a deterrent to occupancy and only those who are working in Noida find it feasible to live there. “Only those who have a job in and around Greater Noida, which is very limited, or those who are retired are living in Greater Noida,” said Pradeep Mishra, an NCR-based real estate consultant.

Connected today only by road, the metro link is still at least two years away. Local transport is negligible with few autos or cabs on the road. What makes the commute to Delhi worse is unavailability of Ola and Uber cabs in these localities.

Infrastructure: Samantak Das, chief economist and national director (research), Knight Frank India, said: “Lack of job opportunity, social and retail infrastructure are the reasons why people don’t want to move in these areas, despite the low ticket size of the houses and apartments.”

A group of residents in Sector XU, next to Sector MU-I, said, “There is no government hospital, schools or shopping complex nearby. Besides, transportation is the main deterrent.”

Court cases: A lot of societies have pending court cases against them which act as a deterrent for people to move in.

For instance, Supertech Ltd, the Noida-based developer that built Czar housing project in Sector Omicron-I, adjacent to Sector Mu-I, has been accused of constructing more number of apartment units than what was actually sanctioned by the authority—1,904 units instead of the sanctioned 844 units. As a result, the Noida authority has sealed the extra number of units. “Out of 8 apartments on my floor, seven are sealed by the authority, and I am all alone on the floor,” said J.K. Akash, one of the residents in Czar housing society, who lives there with his family.

Vacant flats: The vacant flats seem to have created a vicious cycle in terms of discouraging residents from moving in. In many completed projects of private developers, there is a huge amount of unsold inventory. Also, while many projects are complete, they are waiting for occupancy or completion certificates.

BROKER CARTELS

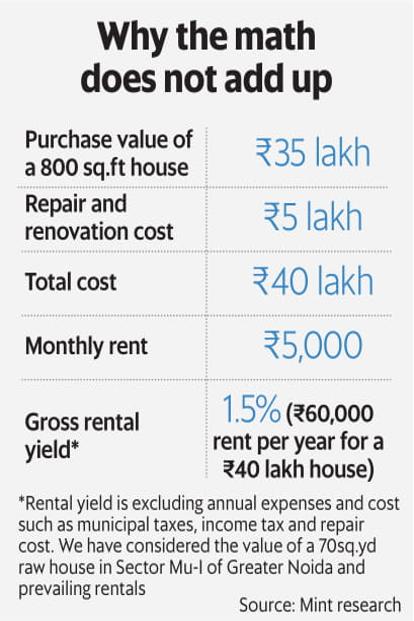

Real estate prices are lower in Greater Noida than other parts of NCR. For Rs 30-35 lakh, you can own a 800 sq.ft row house in Sector Mu-I. Compared to at least Rs 20,000 per sq.ft in most South Delhi colonies, or Rs 10,000-15,000 per sq.ft in Gurgaon, Greater Noida flats at Rs 3,500 per sq.ft are cheap.

Neither is security a big threat. “I don’t face any major challenge living here. No big-security issue except few instances of theft that have taken place since I started living here one year ago,” said 30-year-old IT professional Gaurav Singh, who owns a house in Sector MU-I.

But even this price is too high, and occupancy could improve at lower prices.

The key reason for the ghost complexes of Greater Noida is the broker cartel that does not let the price drop to a level to see the demand, Singh added. When the houses were alloted, brokers and investors managed to corner a bulk of the allotments or bought it from the original allottees and are now sitting on them, waiting for prices to rise.

“They have inflated prices too much and don’t want to bring prices down, house are not worth that much value. Add the poor construction quality of the government flats that need another Rs 10-12 lakh of investment before the house is livable, and the deal becomes unappetising,” said Singh.

“It is unlikely that sellers will bring down the price too much after a certain extent. In some cases, even bringing down the price may not help because there might be no buyers,” said Das.

Owners don’t rent out

Other than brokers holding on to inventory, private investors who bought the great Noida property story don’t want to live there and neither want to rent them out. With rents as low as Rs 4,000-5,000 for a 800 sq.ft house, rental yields are very poor at around 1.5%. This compages poorly to the already low yields in the rest of the country. “Rental yields in India are hardly 2-2.5% in the residential segment, and even lower at about 1% in localities with lack of social and retail infrastructure or far-flung suburbs of metros,” said Das.

Should you sell?

Distance, lack of infrastructure and high prices are the reasons people are not buying. But the forces of demand and supply should have brought prices down by 25-30% for the ghost towns to get living people in them. But both brokers and owners are unwilling to cut their losses and reduce prices. What should you do if you are caught in one of these ghost societies?

Some people are caught in a double whammy of paying rent in Delhi and the EMI in Noida with the rent from the Noida flat covering less than one-third of the EMI. Worse, there has been no capital appreciation in the last few years in these localities and this is unlikely to change in the next few years. “Property prices appreciated in Greater Noida in early 2000 on the back of announcement of an airport in Jewar; the plan was later scrapped. Now that the Jewar airport proposal has been passed, there is some scope of increase in prices but it will take at least 5 years,” said Mishra.

Those who have invested in these areas “should take a hit and exit from their investment, but if they can stay invested for another 7 years or so they can wait,” said Das. Any increase in property prices in near future is unlikely, he added. In that much time, your money can do better in other investments (see graph).

Sell now and cut your losses and move to a better investment. That is if you can find a buyer.

[“Source-livemint”]