India has over 497 million people in the education-seeking category of 5-24 years, or 37.1% of the country’s total population, according to the United Nations.

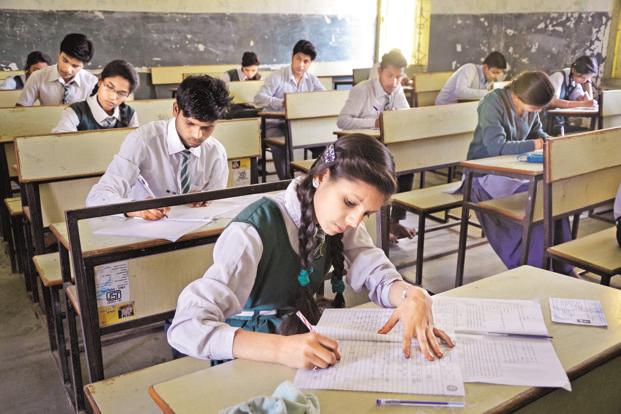

Of these, 377 million young Indians fall in the school-going category of 5-19 years—this demographic dividend has generated considerable optimism, given the potential it offers in accelerating economic growth.

Yet, it is also a sword hanging on our necks if we fail in our duty to educate and skill the emerging generation.

On the face of it, the Indian education sector appears to be in a veritable sweet spot. Education spend is the third largest outlay for middle-class households after food and groceries. By culture and aspiration, we Indians have traditionally placed emphasis and value on knowledge-gathering.

In the modern context, this is borne out in our nation’s emergence as a knowledge-based service economy, powered by the strength of our human capital.

To add to this is the fact that there are unprecedented levels of aspiration among the younger generation of Indians, who see education as a ticket to success.

The Indian dream of this generation is to leave behind their small towns and villages and make it big in the metros—a story that is playing out in the trend of increased urbanisation in the search for a better life.

To be sure, while this augurs well for the youth of today, there is tremendous stress that the primary and secondary education system is already under.

While sectoral growth in education is high, there still remains a challenge for private schools to effectively address the key parameters required for this growth.

Some of these critical parameters include investment on infrastructure, content creation, technology, safety, regulatory compliances, and hiring and retaining high-quality staff. All this requires patient capital, but one of the fundamental issues that private schools face today is the lack of long-term capital to meet their needs.

Lenders provide funding with a tenure of relatively shorter periods, while schools require capital over much longer tenures owing to the lengthier gestation periods. This leaves a gap for a viable alternate source, which can provide long-term capital to the schools.

This is where education REITs (Real Estate Investment Trusts) come in.

REITs provide long-term growth capital minus the debt burden to school owners. REITs provide convenience to the school operators to monetize the physical assets (land and building held in a special purpose vehicle, or SPV) of the school while continuing to use the premises for running the school operations.

The REIT buys the land and building of the school and leases it back for a long-term to school operators.

The sale proceeds are used by the school operators to repay their debt and fund their expansion plans.

Therefore, for the school there is no principal repayment in the REIT structure, instead, they are only obligated to pay monthly rent, which is at times more competitive than the interest costs depending on the cash flows and credentials of the operator.

This asset-light model eases the cash-flow burden of school owners, allowing them to focus on their core strength—improving the quality of education by investing on staff, facilities, safety and compliance, besides expanding operations to take in more students, running a tight ship financially that will lead to higher value creation, availing a structure that gives them liquidity and, ultimately, enhance their brand and valuation.

In short, REITs provide perpetual source of capital at competitive pricing than other forms of long-term capital.

When schools focus sharply on enhancing education standards, this will also ease the burden on government finances (which can then be re-directed to other areas in education) and shall lift the human resources excellence of the country.

All of this aids in accelerating economic and social growth while expanding the education ecosystem at the same time.

Education-focused REITs are a proven model, globally, that bring global best practices, enhanced corporate governance and long-term returns for investors.

It is time the education sector in India gets a financial solution which serves its need in a holistic manner and provides much needed long-term capital to build the intellectual capital of this country.

[“Source-livemint”]