One of the central parts of President Trump’s tax plan is to cut taxes on what are called “pass-through” businesses. Proponents pitch that as a big boost for middle-class owners of small businesses.

But a new analysis from the Tax Policy Center finds that aside from making Trump personally a lot richer, the pass-through provision would almost entirely benefit the wealthy.

TPC finds that the plan could cut almost $2 trillion in taxes over 10 years, but the rich would reap nearly all the benefits:

/cdn0.vox-cdn.com/uploads/chorus_asset/file/8521863/pass_throughs_2.png)

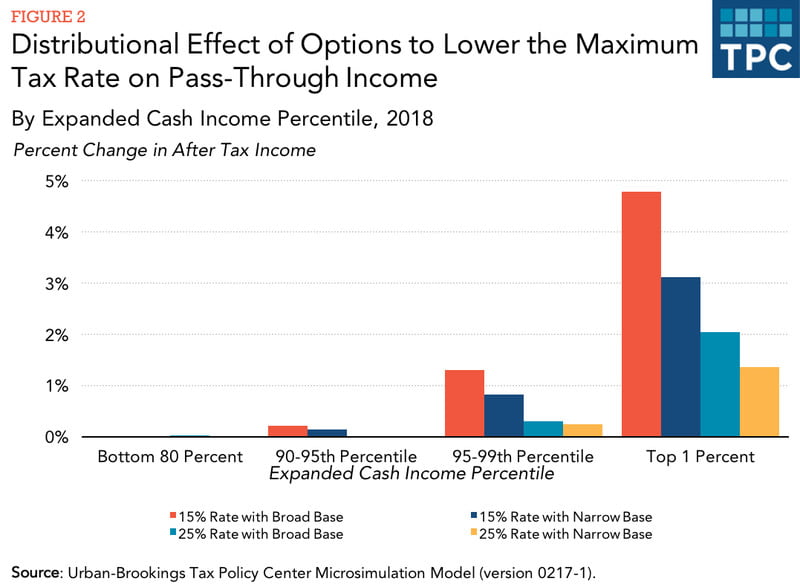

TPC ran its analysis assuming both a 15 percent rate for pass-throughs (Trump’s plan) and a 25 percent rate (House Speaker Paul Ryan’s plan). In addition, they looked at a “broad” definition of income, which includes all owners of pass-through businesses, as well as a “narrow” definition, which only includes owners who are actively involved in the business.

TPC’s Howard Gleckman puts it into real numbers (emphasis mine):

With the broad income definition, three-quarters of the benefit would go to highest-income one percent of households, who make $700,000 or more. They’d get an average tax cut of about $76,000, or 4.8 percent of their after-tax income

By contrast, fewer than five percent of middle-income households would get a tax cut, averaging $370.

This goes counter to the rhetoric that tax breaks for pass-through entities help small businesses.

Just a refresher: Pass-throughs don’t pay corporate taxes but instead disperse money to their owners, who only have to pay individual taxes. That’s because it would be tough for someone owning, say, a small dry cleaning business to pay corporate taxes and individual taxes, which is what traditional corporations have to do. (We have a cartoonsplainer of it here.)

/cdn0.vox-cdn.com/uploads/chorus_asset/file/8522321/pass_through_newpanel.jpg)

But over time, more large corporations started organizing themselves as pass-through businesses — including the Trump Organization. And now a handful of very rich people earn the lion’s share of pass-through income. Everyone else splits a smaller share:

/cdn0.vox-cdn.com/uploads/chorus_asset/file/8521981/passthru.png)

And the wealthiest 1 percent of Americans are the biggest beneficiaries, earning about 69 percent of all pass-through income:

/cdn0.vox-cdn.com/uploads/chorus_asset/file/8523009/pass_trough_woccas.jpg)

Right now, pass-throughs pay an effective federal tax rate of about 19 percent, according to the Treasury Department, which is significantly less than the 32 percent that traditional corporations pay on average. But Trump wants to help these pass-through businesses even more and cap their federal taxes at 15 percent, which would essentially create a special low-cost tax lane for some wealthy business owners — including Trump.

Further reading:

- Vox’s Dylan Matthews writes about how Trump’s tax plan could make himself richer.

- Vox’s Javier Zarracina and I created a visual explainer that shows how pass-through businesses work.

- The Tax Policy Center’s Howard Gleckman explains some of the assumptions they made in their analysis.

- 7 big questions Republicans need to answer on tax reform.

[“Source-vox”]