Contents

With the banks busy chipping away at their mountain of bad loans and operating on precarious levels of capital, who will fund the credit needs of Indian businesses? Reserve Bank of India’s recently released annual report for 2016-17 shows that many new sources of finance are springing up. Domestic businesses are increasingly turning to the bond markets, Non-Banking Finance Companies (NBFCs) and foreign direct investors to meet their funding needs.

RBI’s compilation on the ‘Flow of financial resources to the commercial sector’ shows that FY17 marked a watershed year for Indian banks’ share in commercial credit.

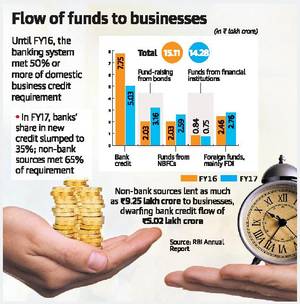

In the four years ended FY17, domestic businesses soaked up between ₹12.8 lakh crore and ₹15.1 lakh crore, per year in credit funding. Until FY16, the banking system met 50% or more of this requirement.

But in FY17, banks’ share in new credit slumped to 35%, while non-bank sources met 65% of the financing requirement. Non-bank sources lent as much as ₹9.25 lakh crore to businesses, dwarfing bank credit flow of ₹5.02 lakh crore. So, who are these non-bank lenders to enterprises and how are they funding themselves?

Bond market buoyancy

For years, market players in India have bemoaned the underdeveloped state of the domestic bond market. But the bond market has seen a remarkable pickup in the last three years.

In FY17, public issues and private placements of corporate bonds (including commercial paper) raised ₹3.16 lakh crore for firms, a 56% jump from the ₹2.03 lakh crore in FY16. This took care of 22% of the total funding requirements of commercial enterprises.

This number has almost doubled from ₹1.65 lakh crore in FY14. This data only includes the bonds directly floated by commercial enterprises, and not the money raised by finance companies for on-lending.

What has prompted this sudden takeoff? On the borrowing side, firms have taken to bond issues to source more of their requirements because bond markets have transmitted the recent fall in interest rates much more quickly and effectively than banks. In the last couple of years, it has been much cheaper for high-quality corporate borrowers to tap bond markets.

On the lending side, retail savings flooding into mutual funds, insurance firms and pension funds have helped stoke the domestic institutional investors’ demand for bonds.

These trends, taken with active efforts by the RBI, suggest that bond markets may continue to remain a leading source of credit to businesses, offering stiff competition to banks. The only caveat is that the bond market route is more accessible to large enterprises with good credit ratings, than SMEs or borrowers with low ratings.

NBFC scale-up

Non Banking Finance Companies (NBFCs) have emerged as key financiers to businesses, especially MSMEs. RBI data shows that in FY17, NBFCs and housing finance companies extended ₹2.59 lakh crore in credit to commercial enterprises, meeting 18% of their total credit needs. NBFC lending jumped 28% over FY16.

For long, it was a sore point with entrepreneurs that the large corporate borrowers ended up cornering the lion’s share of bank credit, with lending procedures effectively keeping out Micro Small and Medium Enterprises. In the last three years though, wholesale NBFCs have aggressively stepped into the breach. Leveraging their deep regional reach, closer relationships with customers and alternative credit appraisal systems, NBFCs have driven a manifold expansion in loans against property and unsecured business loans to MSMEs.

‘NBFCs gain share’

A Crisil study in November 2016 noted that NBFCs had gained a 3 percentage point share of overall credit pie from banks in the last three years as a result of their mortgage and MSME lending push, and would continue to gain share over the next three years. Housing finance NBFCs have emerged as a major source of funds for real estate developers too, with financial institutions such as LIC, SIDBI, National Housing Bank and NABARD playing a complimentary role in funding other businesses.

Two factors have helped NBFCs expand their lending activities at the cost of banks — their comfortable capital adequacy ratios and their ability to borrow at lower costs due to falling interest rates. In the last couple of years, NBFCs have been even more aggressive than corporates in tapping the bond markets for capital. They have also augmented their resources by borrowing from banks and institutional investors through securitisation deals. Lately though, there is worry the sluggish property market will force NBFCs to tread more cautiously on loans against property.

While domestic non-bank sources such as bond markets and NBFCs have met about 46% of the total credit needs of businesses in FY17, foreign sources have chipped in with about 19% (₹2.75 lakh crore).

Here, the good news is that rather than External Commercial Borrowings or short-term credit, it is the more durable FDI money that is meeting this need.

While it heartening to see these alternative sources filling in for bank credit, it is essential to recognise that these cannot completely substitute for bank lending. In April-June 2017 for instance, bank credit flow to the commercial sector actually shrank by ₹1.92 lakh crore. Despite non-bank sources pumping in ₹1.65 lakh crore, the aggregate flow of finance to business contracted by ₹27,300 crore.

The other useful takeaway from the analysis is that one can no longer assume a one-to-one correlation between bank credit growth and the GDP growth numbers. To really measure credit expansion in the economy, we need data on both bank and non-bank lending. To extend this logic further, if bank credit growth slumps to a 20-year low as it did in March this year, it needn’t necessarily spell doom for the economy.

[“Source-thehindu”]