Image: Shutterstock

“Wires and cables are a high value business, and after the rollout of GST, it leaves little room for unorganized players,” says Syska Group director Rajesh Uttamchandani, explaining the trigger for taking the plunge into a segment which so far has been highly unorganised. Pegged at over ₹8,000 crore, domestic cable market in India has a low level of penetration by organized players. Industrial cable market, estimated at ₹12,000 crore, too doesn’t have many players.

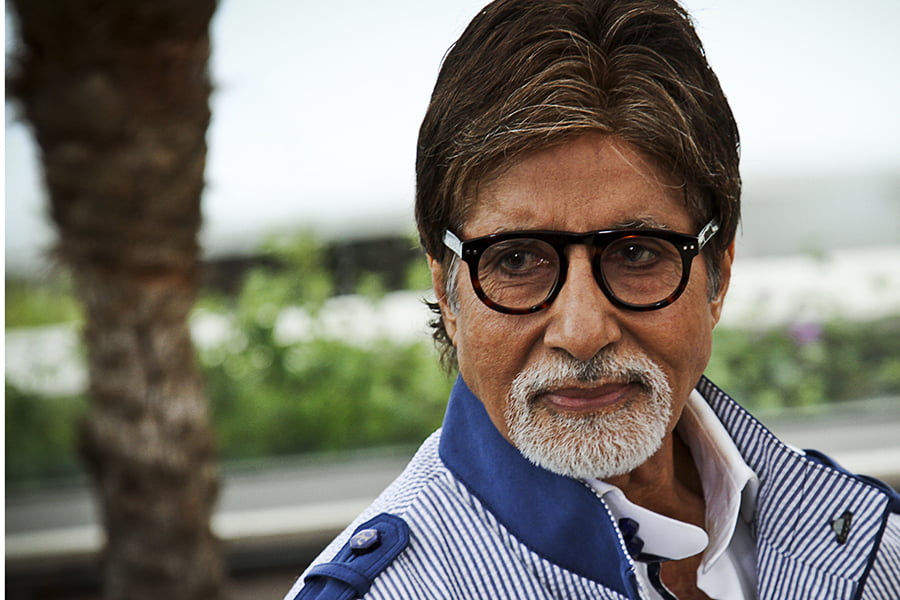

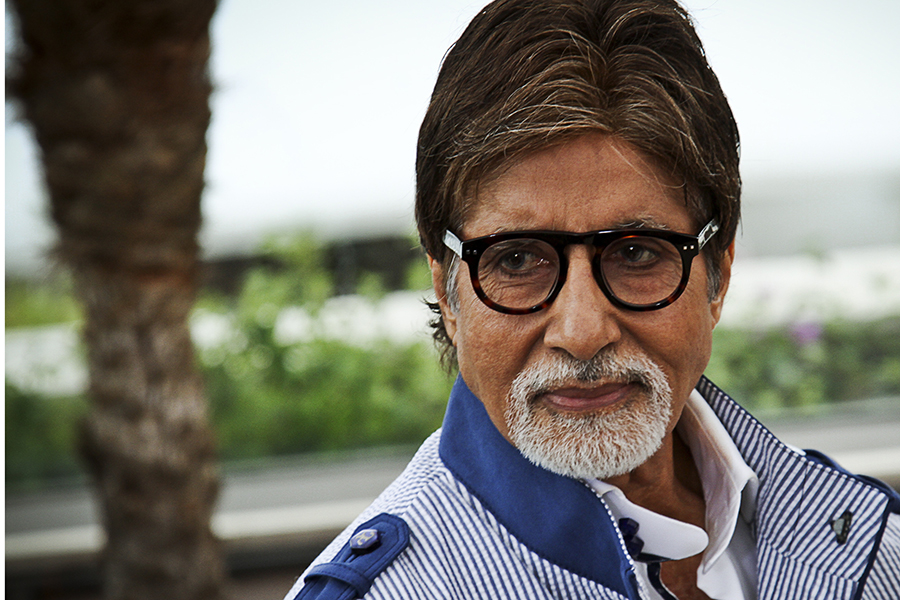

The Pune-based homegrown major is also rolling out Miniature circuit breaker (MCBs) and Residual Current Circuit Breaker (RCCB), adds Uttamchandani. The company plans to use its extensive network of four lakh dealers across India to push its cable business. “Syska is already a household name and Amitabh Bachchan will take the brand to another level,” he contends.

Interestingly, Amitabh Bachchan endorses Lloyd brand, which is owned by rival Havells.

The brand extension into the cable segment is timely, market experts say, as wires have morphed from commodity to a brand. What might also help Syska is ‘later-comer advantage.’ With players like Havells, Polycab and V Guard already doing the ground work to shift the market towards organized players and create consumer awareness around ‘branded’ wires, Syska will find it easier to penetrate unlike the first-movers who had to start from the scratch.

“From LED to wire is a smart move that signals the intent of Syska to go deeper into the homes of consumers,” says Ashita Aggarwal, head of marketing at SP Jain Institute of Management and Research. The company recently introduced Wi-Fi enabled smart lights which are compatible with Amazon’s digital assistant Alexa.