The Goods and Services Tax Council decided on Sunday to cut the tax on under-construction houses to 1% for properties valued up to ₹45 lakh and to 5% for those in the premium segment in order to boost the troubled real estate sector and provide relief to aspiring homebuyers.

The rates will be brought down from the existing 8% and 12%, respectively.

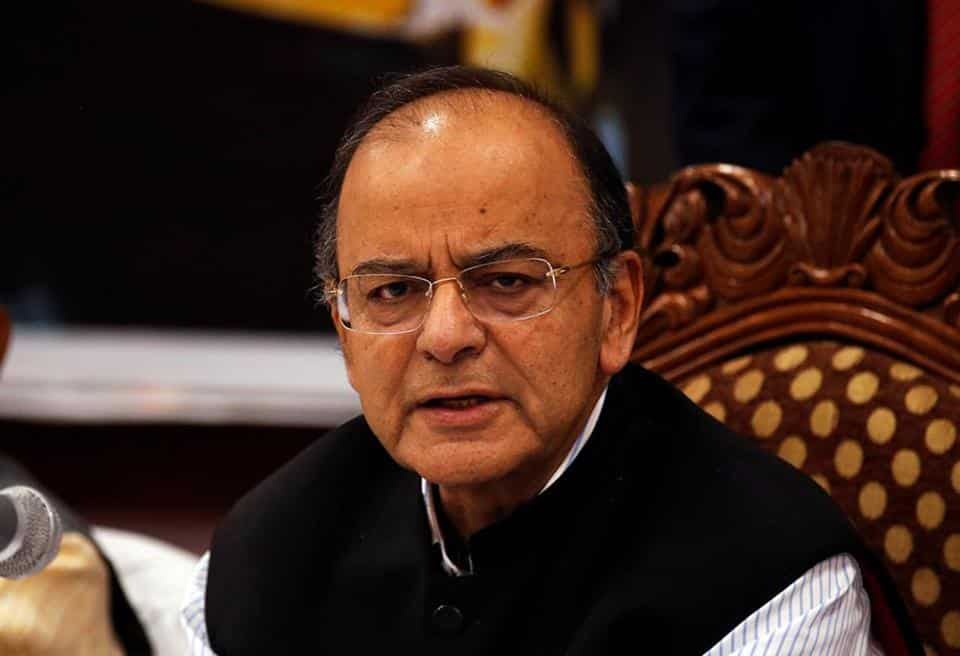

“In its 33rd meeting the GST Council has accorded big relief to the real estate sector. GST rate on affordable housing has been reduced to 1% from 8% and for others [premium segment] from 12% to 5% for both without input tax credit. This will give a boost to housing for all and fulfil the aspirations of the neo-middle classes,” said finance minister Arun Jaitley, who is also the chairman of the council.

“The new GST rates will be applicable from April 1,” Jaitley said after a meeting of the council that decides on matters related

to indirect taxes and has representation of state finance ministers.

GST is levied on under-construction properties or ready-to-move-in houses where a completion certificate has not been issued at the time of sale. Sale of properties after a completion certificate is issued attracts stamp duty.

Jaitley said the council also expanded the definition of affordable houses for the purpose of GST, which is based on carpet area instead of the common practice of super area whereby builders often allegedly cheat gullible buyers.

Besides being up to ₹45 lakh in value, a property must not exceed 60 square metres carpet area to be eligible for the 1% GST rate under the affordable segment in metro cities, including Mumbai Metropolitan Region and Delhi-NCR. This criterion will be relaxed to 90 square metres of carpet area for non-metros.

Under this criterion, one can now have a two-bedroom flat in a metro city and a three-bedroom flat in a non-metro, the minister said.

Consensus on GST rates and the definition of affordable housing in the council was reached after a marathon debate on various aspects that took more than two hours, an official present in the meeting said requesting anonymity.

West Bengal finance minister Amit Mitra had written a letter to the council on Thursday demanding 1% tax on affordable housing saying the proposed 3% GST on this segment would “actually increase the tax burden on the small home buyers”.

Last month, a group of ministers headed by Gujarat deputy chief minister Nitin Patel recommended cutting tax rates for under-construction residential properties in the premium segment to 5% and 3% in the affordable category.

Jaitley said the council deliberated on the possibility of builders committing tax evasion as they would not get input tax credit on building materials such as cement and steel. In order to prevent builders from reverting to cash purchases of inputs, the council will make it mandatory for them to buy a certain percentage of building materials from registered buyers, the minister said.

This percentage and other finer details will be worked out by the fitment and law committees, which will submit their drafts by March 10. Then the council will meet through video conference to decide on these matters, Jaitley said. A physical meeting of ministers is not possible during the period because most of them will be busy in the general elections.

Experts said gains from lower tax might not be proportionate to the rate cuts as builders would increase the base price of properties as compensation for the input tax credit.

Pratik Jain, partner and leader indirect tax, PwC India, termed it a “quick fix” solution to the perception that the industry was not passing on the benefit of input tax credit to customers, as was the case with some restaurants.

“Developers would need to increase the base price to recover the loss of input credit but would need to be cautious given the surge in anti-profiteering investigations for restaurants in similar circumstances,” Jain said.

MS Mani, partner, Deloitte India, however, said, “With these reductions, the GST rate on normal under-construction apartments would be a little lower than that prior to the introduction of GST and that on affordable housing would be significantly lower than before.”

The industry gave a mixed reaction, as it saw a possible spurt in demand for properties but felt the denial of input credit was a major dampener. “This announcement gives an impetus to affordable housing and will enthuse homebuyers to close the sale deals. The GST rate on cement has not been reduced as was expected. At 28%, it remains among the highest taxed inputs for construction – and there will be no input tax credit, so developers will face a challenging time,” said Niranjan Hiranandani, national president, National Real Estate Development Council.

“The real estate and housing sector drives construction and is a key employment generator and we believe today’s decisions for a better and simpler tax regime will boost offtake of housing, thereby also contributing to job creation,” Chandrajit Banerjee, director general, CII, said.

The council could not take up the second matter on the agenda, which was related to lotteries, due to the absence of two member-states, Kerala and Punjab. The group of ministers on lotteries will meet again to discuss the matter. Currently, state-run lotteries attract 12% GST while state-authorised lotteries attract GST at the rate of 28%.

[“source=hindustantimes”]